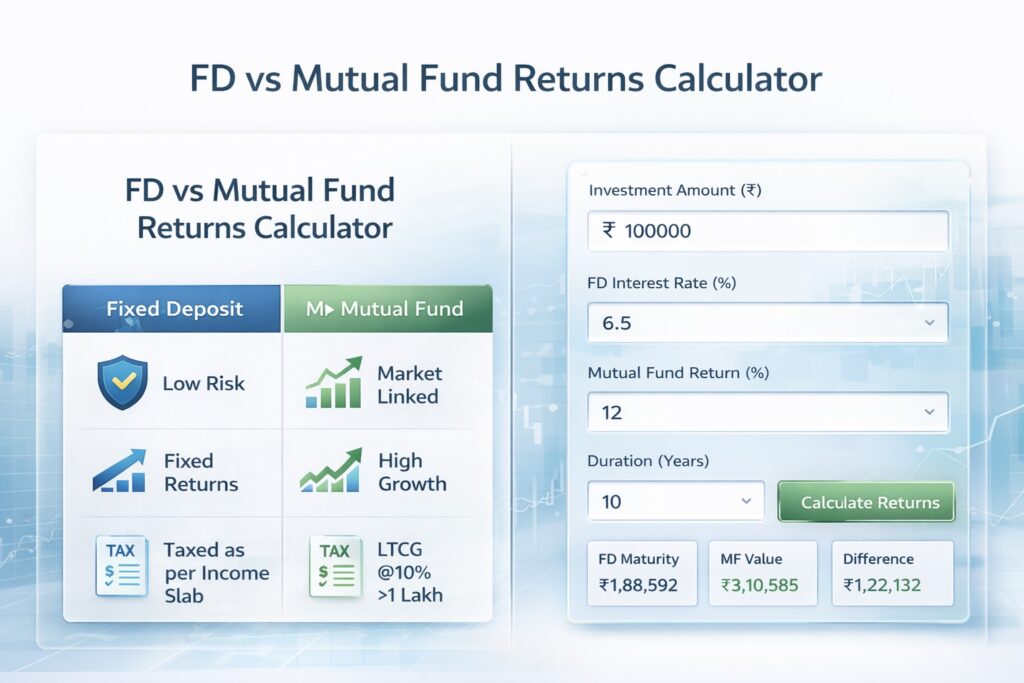

Confused between the guaranteed safety of a Fixed Deposit (FD) and the growth potential of Mutual Funds (MF)? Don’t just guess. Our FD vs mutual fund calculator below lets you compare their projected returns side-by-side in seconds, factoring in the critical impact of taxes.

FD vs Mutual Fund Returns Calculator

The numbers from this FD vs mutual fund calculator don’t lie. As you can see from the results above, even a small difference in the expected rate of return can create a massive gap in your final corpus over time. This comparison is the first step towards making an informed investment decision. However, the “better” option depends on more than just math. Scroll down to understand the key differences in risk, liquidity, and tax treatment between FDs and Mutual Funds, and learn how to choose based on your personal financial goals.

FD vs Mutual Fund: A Detailed Head-to-Head Comparison

The table below breaks down the two investment avenues across key parameters to help you understand beyond just returns.

| Parameter | Fixed Deposit (FD) | Mutual Fund (Equity-oriented) |

|---|---|---|

| Core Nature | Fixed Interest Rate, Capital Protection | Market-Linked Returns, Capital at Risk |

| Return Nature | Fixed & Guaranteed (Rate is predetermined) | Variable & Not Guaranteed (Depends on market performance) |

| Risk Level | Very Low (Negligible) | Moderate to High (Subject to market volatility) |

| Liquidity | Premature withdrawal usually incurs a penalty. | SIPs can be stopped; units can be redeemed at the current NAV. |

| Tax Implication | Interest is added to your income and taxed as per your slab. TDS applies. | Long-Term (>1 year): 10% LTCG (over ₹1 Lakh gain/yr) Short-Term: 15% STCG |

| Ideal For | Risk-averse investors, those needing fixed income, short-term goals (< 3-5 years). | Investors who can tolerate risk, long-term wealth creation goals (5+ years horizon), beating inflation. |

How to Choose: Align with Your Financial Profile

- Define Your Goal & Time Horizon: Is this investment for a down payment in 3 years or your child’s education in 15 years? For short-term goals (<3-5 years), FDs generally suit you better. For long-term horizons (>5-7 years), equity mutual funds have historically outperformed inflation.

- Honestly Assess Your Risk Tolerance: Will you lose sleep if your investment’s value drops 10-15% in a market correction? If yes, an FD’s stability might better suit your peace of mind.

- Factor in the Tax Impact (Use Our Calculator!): Your income tax slab determines the tax on FD interest, which can significantly reduce your effective return. For equity funds, you pay Long-Term Capital Gains (LTCG) tax at 10% (over ₹1 lakh gains per year). Our calculator above helps you clearly compare the ‘post-tax’ value of both options.

How to Use This FD vs Mutual Fund Calculator for Accurate Results

Our FD vs mutual fund calculator is designed to be simple yet powerful. Follow these steps to get the most accurate comparison for your financial planning:

- Enter Your Investment Amount: Start by inputting the total lump sum amount you plan to invest. This is your principal.

- Set the Time Horizon: Choose the number of years you intend to stay invested. Remember, mutual funds generally benefit from longer durations (5+ years).

- Input Expected Returns:

- For FD, use the current interest rate offered by your bank (e.g., 7.0%).

- For Mutual Funds, use a conservative long-term average between 10-12% for equity funds. You can adjust this to test different scenarios.

- Review the Tax Impact: The calculator automatically estimates the post-tax value. Notice how taxation significantly affects FD returns if you fall in a higher tax slab.

- Analyze the Final Comparison: Look at the “Difference in Returns” or final corpus value. This clear number shows the potential opportunity cost or gain of choosing one option over the other.

💡 Pro Tip: Don’t just rely on one calculation. Use the FD vs mutual fund calculator multiple times with different durations (like 5, 10, 15 years) to see how time magnifies the return gap. This will solidly prove why long-term goals align better with mutual funds.

Asked Questions (FAQs)

While your principal is protected by the bank/institution, inflation risk is real. If your FD’s interest rate is lower than the inflation rate, the purchasing power of your money is actually decreasing over time.

Yes. Mutual funds, especially equity funds, are subject to market risks. However, over long periods (7-10 years), markets have historically shown an upward trend and have beaten inflation.

While past performance isn’t indicative of future results, for long-term calculations, a conservative estimate of 10-12% annualised return for equity-oriented funds is often used, based on historical market averages. Our calculator lets you adjust this rate to match your expectations.

For the most accurate and updated information, you should always refer to the official regulatory bodies. Specifically, here are the primary sources for each investment type:

For Fixed Deposits (FDs): The Reserve Bank of India (RBI) is the primary regulator. Therefore, for the latest guidelines, FAQs, and resources on bank deposits, you can visit their official portal: RBI: Bank Deposits – FAQ.

For Mutual Funds (MFs): On the other hand, mutual funds in India are regulated by the Securities and Exchange Board of India (SEBI). To find the most current and official information on fund schemes, their performance, and key documents, we recommend the following steps:

First, visit the official SEBI website: https://www.sebi.gov.in.

Then, use the website’s search function or navigate to the ‘Mutual Funds’ section under the ‘Information for’ menu.

Alternatively, you can also visit the websites of individual AMFI-registered Asset Management Companies (AMCs) like SBI Mutual Fund, HDFC Mutual Fund, etc., for specific scheme details.

Conclusion: Choose Your Path Wisely

No single investment is the ‘best’—only the ‘most suitable’ for you. This calculator and guide give you a data-driven and informed starting point.

📈 Your Next Step: Use the results from this calculator as a starting point. For a personalised plan, we strongly recommend consulting with a SEBI-registered financial advisor.

Did you find this page helpful? Share your investment questions or calculator results with us on our [contact page]. Tell your friends about this tool so they can also make smarter investment decisions.